Looking for information on how to form an LLC in Wyoming? You’ve come to the right place!

This guide will walk you through every step you need to form an LLC in Wyoming and get your business started on the right foot. Read on to learn more.

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

Choose a Name for Your Wyoming LLC

Choosing a name for your business is always the first step in forming an LLC in Wyoming. Be sure to choose a name that your potential clients can remember and pronounce — and one that relates to your Wyoming business activities. The simpler, the better, in our opinion.

It is also vital that your chosen name complies with the naming rules and guidelines in the United States, specifically in Wyoming. This includes the following:

- Your Wyoming LLC name should be distinguishable and unique

- Restricted words (such as University, Attorney, Bank, etc.) might need extra paperwork and a licensed individual (doctor or lawyer) to be part of your Wyoming LLC

- Your chosen LLC in Wyoming should not include phrases that confuse your LLC with government agencies.

- The chosen name should also have the words: “LLC, ”limited liability company,” or “L.L.C.” at the end.

Once you have a name in mind, we recommend running an LLC name search on the Wyoming Secretary of State Website to ensure your chosen business name is available.

Finally, check if your Wyoming LLC name is available as a web domain. This is essential if you want to establish a solid online presence for your business entity.

Hire a Registered Agent

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

Every LLC in Wyoming is required by the Secretary of State to nominate a registered agent.

A Wyoming registered agent is any person (or service provider) assigned to receive legal documents, tax forms, and other correspondence documents from the government on behalf of your LLC.

The registered agent can be yourself, a friend or family member, or another member or employee of your Wyoming LLC. You can also hire a registered agent company or service provider.

In order to act as a registered agent in Wyoming, a business entity or person must have a permanent street address in Wyoming. They must also be available to accept correspondence documents during regular working hours.

We recommend hiring one of the following top registered agent service providers:

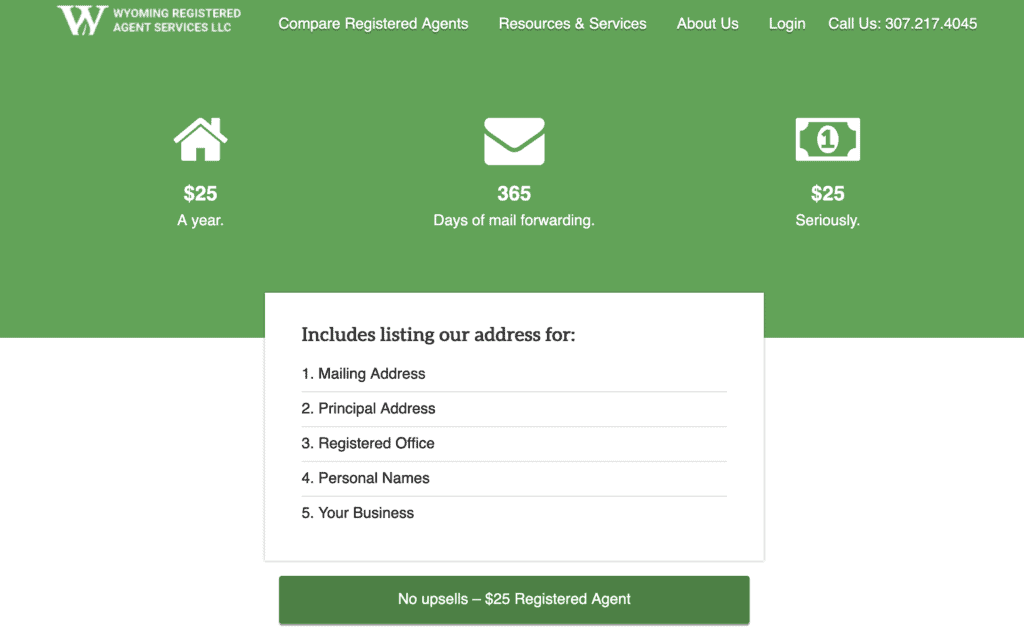

Wyoming Registered Agent

If you are looking for an affordable and local registered agent, consider hiring Wyoming Registered Agent. This cost-effective and comprehensive registered agent costs just $25 per year. In return, you will get access to compliance reminders, same-day forwarding, access to an online account, and mail forwarding.

One good thing about the affordable cost of a Wyoming Registered Agent is that it comes with no strings attached or hidden costs. For instance, the fees remain the same yearly, and the pricing is transparent.

Northwest

Northwest is another top registered agent service provider in Wyoming. They provide premium customer support and a comprehensive package of registered agent services. Northwest is reputable for its customer support called the Corporate Guides. Their experienced customer support experts are always available to assist you with any compliance-related issue.

During your first year with Northwest, you will even get access to a user-friendly website and compliance Calendar.

A year with Northwest costs only $125, and if you hire their registered agent services in 4+ states, the fee will be reduced to just $100.

IncFile

IncFile is another big name in the registered agent industry. It has helped more than 800K customers over the years.

Being a nationwide LLC formation and registered agent company, you can use it as your registered agent if you want to expand your registered agent services beyond Wyoming.

IncFile will give you access to regular complaint notifications, which is vital in meeting all the Wyoming state deadlines.

The standard fee for their registered agent service is $119 per year. You will receive a free year of IncFile’s registered agent services if you purchase IncFile’s LLC formation services.

File Articles of Organization

After choosing a company name and nominating a registered agent for your Wyoming LLC, the next step is to register your LLC with the Wyoming Secretary of State.

The simplest way to do this is to file an Article on Organization online with the Wyoming Online Business Formation System by filling out an online form and paying the $100 state filing fee.

If you don’t want to use the online system to register your LLC, you can file your Article of Organization by mail. If you opt for this option, you must download and fill out the Wyoming Articles of Organization LLC Form, and then mail it together with a check or money order for the state filing fee to the following address:

Wyoming Secretary of State, Herschler Building East

Suite 101, 122 W 25th Street

Cheyenne, WY 82002-0020

Create an Operating Agreement

This is a legally binding agreement that outlines how our LLC will be run, how the profits will be shared, and how the LLC can be dissolved.

It covers other essential information, including the following:

- How your LLC will handle voting

- Liability and indemnity clauses

- Rules of adding and removing members and transferring membership interests

- Voting rights and rules

- The business management structure, whether member-managed or manager-managed.

- LLC ownership information, including each member’s ownership percentage

- Purpose of the LLC

Like most states, the Wyoming Secretary of State does not require LLCs to have an Operating Agreement. However, we recommend drafting a Wyoming LLC Operating Agreement as it ensures that all members and managers are on the same page regarding LLC operations. An Operating Agreement can also help prevent conflicts and miscommunication among LLC members.

Obtain Licenses and Permits

The state of Wyoming is relatively lenient when it comes to business licenses. However, certain business entities in Wyoming may need state licenses and permits to operate. We recommend visiting the Wyoming Business Licensing website to learn more about your state business licenses and permit requirements and needs.

You may also need licenses and permits from your county, town, and city. The license requirements and fees may vary based on your type of business, location, and sector. So, check with the relevant body to understand your local government license requirements and rules. For example, all LLCs in the City of Richmond need a city business license, which must be renewed yearly.

Acquire Federal and State Tax IDs

You will also need a Federal and State Tax ID for your Wyoming LLC. Also called an Employer Identification Number (EIN), it is akin to a social security number for your business and is used by the Internal Revenue Service to track your LLC for tax purposes.

An EIN is vital for many LLC functions, including the following:

- Hiring employees

- Opening a business bank and credit account

- Filing business tax returns

- Paying income tax at the state and federal levels.

- Applying for business licenses and permits

One-member LLCs are technically not required to obtain an EIN unless they intend to hire employees or file tax returns as a corporation.

Applying for and obtaining an EIN in Wyoming is straightforward and free via the IRS website. You can also apply for it by fax or mail using Form SS-4. Once your application is completed and validated, the IRS will assign you an EIN immediately.

Open a Business Bank Account

It might appear premature to open a bank account before your LLC starts making money, but this is a vital step in the formation of your Wyoming LLC for both legal and administrative protection. LLCs are regarded as separate legal entities. So, the personal assets of members can not be used to pay off obligations or debts of the LLC.

Opening a business bank account in Wyoming is straightforward. You only need to visit a bank of your choice with the following documents:

- Your EIN

- Article of Organization

- Business License

- Operating Agreement

Some banks may also need a small opening deposit. There are plenty of Wyoming banks to choose from, including the following:

Purchase Wyoming Business Insurance

If your LLC has more than two employees, excluding the LLC members, Wyoming state laws require that you purchase workers’ compensation insurance. This policy protects your employees in case they become ill, get injured, or even die as a result of their job.

While there is no other mandatory insurance policy, we recommend getting additional insurance policies. The broadest insurance cover is general liability insurance, which protects against lawsuits, property damage, and injuries.

If your Wyoming LLC offers professional services, such as accounting, you must purchase professional liability insurance. Also referred to as omissions and errors insurance, this insurance policy is used if your LLC is accused of malpractices or other professional errors.

Buy an LLC Formation Package to Speed Up the Process

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

Many companies offer LLC formation packages that you can purchase to streamline and speed up the process of forming your Wyoming LLC. Regardless of your budget, you will always find a perfect package for your needs, as some packages are entirely free.

For example, ZenBusiness is a top LLC formation company with free and paid packages. Their Starter package is entirely free, excluding state filing fees. It has a standard filing speed, and your Wyoming LLC will be formed in 2-3 weeks.

ZenBusiness’ most popular package is the Pro package. It comes with worry-free compliance, an operating agreement, and an expedited filing speed, as your LLC will be formed in 4-6 working days. You can also opt for their Premium package, which costs $299 plus the state fee. In return, your LLC will be up and running in 1-2 business days.

Another top company that provides LLC formation packages is LegalZoom. With their free Basic package, you will have all the tools and resources to streamline and speed up your LLC formation process. You only need to cover the state filing fee.

Their Pro package costs only $249 plus a state fee, and it is a perfect option for business owners looking for a comprehensive LLC formation package. If you have more money to spend on forming your LLC, you can purchase their Premium package at $299 plus the state fee. In return, you will get expedited processing times.

FAQs About Forming an LLC in Wyoming

How Long Will It Take to Form My Wyoming LLC?

It takes around 10-15 business days to form an LLC in Wyoming. If you file the Article of Organization online, the process is fast, as your Wyoming LLC will be ready within 24 hours.

How Much Does It Cost to Set Up an LLC in Wyoming?

The cost of forming an LLC in Wyoming is $100. This is the cost of filing an Article of Organization with the Wyoming Secretary of State. If you want to reserve your LLC name, you will be charged an additional $50.

Can I Act as my Own Registered Agent in Wyoming?

Yes. You can nominate yourself as a registered agent for your Wyoming LLC. However, you must meet the requirements for being a registered agent in Wyoming. For example, you must be at least 18 years old and a permanent resident of Wyoming. You must also have a physical street address in Wyoming (a P.O. box address is not enough). Moreover, you must be available to accept legal and state documents at all business hours in Wyoming.

Can I Form a Single-Member LLC in Wyoming?

Yes. The state of Wyoming allows business owners to form single-member LLCs by following the steps discussed in this guide. However, you must comply with the relevant state laws for forming a single-member LLC in Wyoming.

Conclusion

That is it! We hope you have an idea of what it entails to form an LLC in Wyoming.

Once your LLC is formed, you must keep it compliant and in active status with the Wyoming Secretary of State’s website. You must also file an annual report with the Wyoming Secretary of State by the last day of the month your LLC was formed to avoid getting penalized.

Leave a Reply