With thousands of flourishing businesses and a plethora of thriving industries, California is an excellent location to start a Limited Liability Company.

If California is where you want your future LLC to be located but you don’t know which steps are required to get there, our helpful guide on how to form an LLC in California will guide you through the process.

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

On top of providing you with a thorough explanation of what every step entails and useful links that will help you complete these steps in no time, we also answer some important questions regarding the cost of forming an LLC and the length of the whole process. In addition, we’ve included registered agent and formation service recommendations that are guaranteed to help you speed up this process.

With that out of the way, let’s delve into the first step of forming an LLC in California – finding the right name for it.

Find the Right Name for Your California LLC

During the formation process of your business, you’ll be asked to submit many documents and forms where you’ll have to include your business name, so this is the obvious first step.

A good business name sounds professional and accurately represents the type of services or goods you bring to the market.

In every state, you’re not permitted to use a name that’s already taken by another business. Your business name has to be unique, and to help you determine if this is the case, you can do an online business entity search on the California Secretary of State website.

Once you ensure that the business name is available, you can reserve it by filing a Name Reservation Request. Your business name will remain reserved for 60 days, giving you ample time to sort all the other formation documents required for your LLC to legally operate. The filing fee for this request is $10.

The California state law dictates that your business name should include a word that denotes its business structure. In the case of LLCs, you can use the full name of the structure – “Limited Liability Company” – or opt for an abbreviation such as “LLC” or “Co.”.

Just like enforcing what words your business name should have, the state also has a few restrictions regarding which words you’re not allowed to use. For instance, you’re not permitted to include words in your business name that allude to any affiliation with a government agency, such as “FBI”, or words like “trust”.

Additionally, you might want to check if the domain name that corresponds with your business name is also available. Most businesses nowadays require a website, and it’s a good idea to purchase a domain name early on in the process.

If you’d like to read more about the LLC naming rules in California, check out the California Code of Regulations – Business Entity Names section on the California Secretary of State website.

Hire a Registered Agent Service

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

In the state of California, all businesses are required to appoint a registered agent in the initial stages of forming a business and maintain a registered agent while their business operates.

There are several criteria a registered agent has to meet. They have to be over 18 years old, have a physical address in the state of California, and be available on-site during regular working hours.

Your registered agent can be either an independent contractor or a company that offers a registered agent service. You can appoint someone you know as your registered agent, or even appoint yourself, but that might result in a few drawbacks. For instance, you will be required to share your private address on public records, and you won’t have flexible working hours or any flexibility in terms of traveling. This is why we recommend you choose a comprehensive registered agent service to represent your business.

Here are our top three picks for some of the best registered agent services across the United States.

1. Northwest

If you’re looking for a well-rounded yet affordable registered agent service, Northwest is an excellent option. Known for their outstanding customer support known as Corporate Guides, Northwest will give you access to all the tools you need to remain compliant with the California laws, such as scanned documents, compliance alerts, access to pre-filled state forms, and annual report reminders. Additionally, your privacy and data will remain protected thanks to their Privacy by Default Practice.

Their regular fee is $125, but they offer a volume discount for anyone who wants to purchase their registered agent services in four or more states, lowering the fee to $100.

2. IncFile

If you’re interested in purchasing a formation package along with a registered agent, IncFile offer a great deal – with every formation service, you’ll get a complimentary year of registered agent services. Their offer includes various perks, such as automatic mail forwarding, access to all your correspondence on a digital dashboard, and customized email and text notifications.

Their fee is quite affordable – a year of registered agent services with IncFile will cost you $119. Plus, you’ll never have to worry about any added fees or unwanted contracts.

3. ZenBusiness

ZenBusiness is one of the best registered agent services across the United States. It’s rated as the #1 service on influential sites like Forbes and MarketWatch. Once you sign up for their registered agent services, you will be given access to document scanning, a personalized dashboard, email notifications, and mail forwarding. On top of that, ZenBusiness are known for helping out the community and financially supporting entrepreneurs to start and grow their businesses, all with their $5K Grant Program.

Their yearly fee is $199.

File Articles of Organization

In California, every LLC owner is required to file articles of organization with the state.

Articles of organization is a formation document where you submit important information about your business, such as its location, purpose, and type, as well as information regarding the management structure. In addition, you’ll be asked to provide basic information about your registered agent, so by this point, you’ll need to have chosen a registered agent to represent your business.

You have two options when it comes to filing articles of organization – online and by mail/in person. Filing the articles online is the fastest and easiest way to go about it. You can access the document on the California Secretary of State website. If you’d like to send it via mail, you can read more information about their working hours and location in the Contact Information – Business Entities section.

The cost of filing articles of organization in California is $70. You should be able to receive approval of your application in 7-10 business days.

Create an LLC Operating Agreement

The state of California doesn’t require LLCs to get an operating agreement. However, crafting an operating agreement is always a good idea for several reasons. It gives you clear instructions about the management of the LLC, identifies the liability clauses, provides information about the different members and all their responsibilities, and states the division of profits and losses. Apart from that, you will also be asked to provide some basic information about your business, such as the duration of it, its purpose, and information about your registered agent.

Since the abovementioned topics are often the cause of disputes in the workplace, spending some extra time on putting together an operating agreement is worthwhile. It can prevent conflict and each member will be aware of their responsibilities in the business. Additionally, it’s a great way to ensure that your personal assets remain protected in case the LLC is dissolved.

File Tax Reports

Every LLC in California is required to pay an annual tax. The yearly tax for LLCs will set you back $800 and you have until the 15th day of the fourth month from the date you file your LLC to pay your annual tax. Even if you’re not actively doing business in the state, you will be asked to pay the annual tax as long as your LLC exists. You can pay your annual tax online or via mail.

In addition, you should keep in mind that if your LLC profits exceed $250,000, you will be asked to pay a certain fee.

If your business includes selling certain types of goods, you’ll also be required to pay a sales tax. You can read more information about the California sales tax on the California Department of Tax and Fee Administration website.

Acquire the Necessary Business Licenses and Permits

Another mandatory step you’ll need to complete before your LLC can legally operate is getting all the required licenses and permits for your business. The type of licenses and permits you need depend on your specific industry, as well as the location of your business.

In California, there’s no state business license, but all businesses are required to get a general business license in the city where their business is located.

If your business is in specific industries, such as health and safety, you might have to get a professional license.

If you’d like to obtain more information about LLC licensing in California, you can check out the Licenses section on the Department of Consumer Affairs – Contractors State Licensing Board website.

In addition, just like doing an online business entity search, you can also complete a business license search on the California Governor’s Office website to determine the specific licenses you’ll need for your business.

Obtain an Employer Identification Number

An Employer Identification Number is like a Social Security Number for your business – it helps identify your business for tax purposes. Not all businesses are required to get an EIN – you’re only legally obliged to get one if you’ve hired employees for your business or if your business is taxed separately from you.

Even if your business isn’t legally required to get an EIN, it can make it significantly easier for you to file your tax returns and open a business bank account. It also increases your chances of being given a business loan since your business will be deemed as more reputable, and it can even prevent identity theft.

You can apply for an EIN on the IRS website. The application doesn’t have a fee and it’s very easy to complete.

Get a Formation Service

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

Forming an LLC isn’t easy, and if you’d like to get some help with the steps listed above, you might want to consider hiring a formation service from a company.

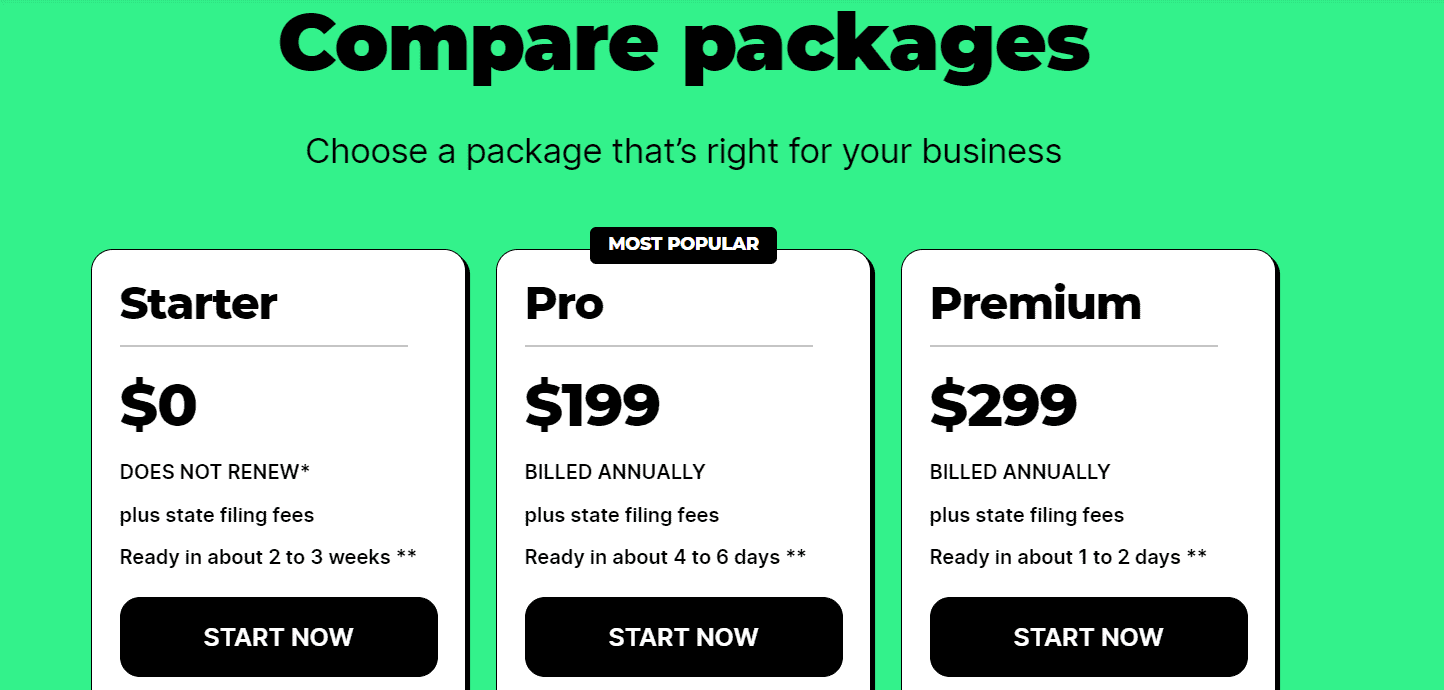

There are various formation packages available for LLC owners, some of which are even free of charge. Such is the case with ZenBusiness – they offer a comprehensive Starter Formation Package that comes with all the tools you’ll need to form your LLC. You’ll only be asked to cover the state fees. In addition to their basic formation package, they also offer two additional formation packages – the Pro Formation Package ($199) and the Premium Formation Package ($299). These packages come with added benefits that will make the process of forming an LLC much easier, like providing you with a domain name and offering worry-free compliance.

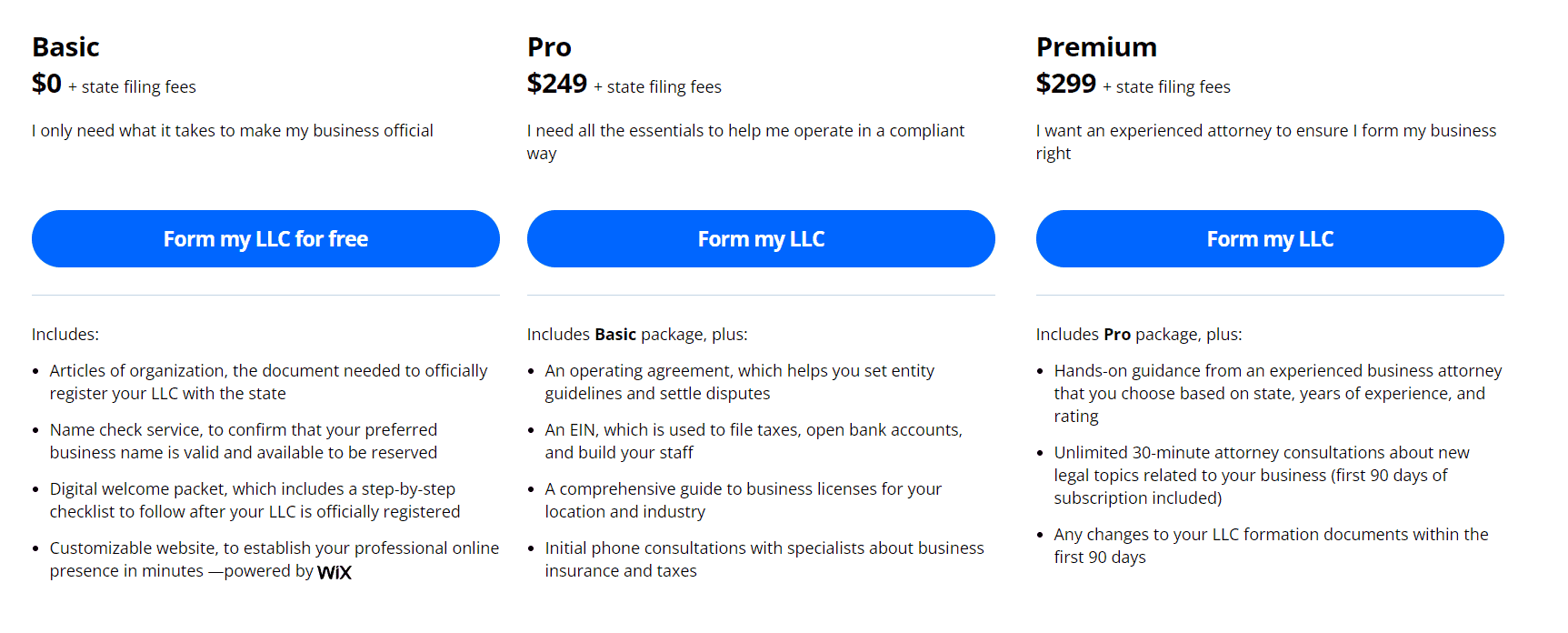

LegalZoom is another reputable company that offers various LLC formation packages. Just like ZenBusiness, they have a basic formation package that is free of charge – you’ll only be asked to pay for the state fees. They have additional options for those who don’t mind spending a little extra money on a formation package. For instance, their Premium package provides you with guidance from a business attorney, various one-to-one consultations, and help with the formation documents. If you want advice from experienced attorneys from the leading legal services company, then don’t hesitate to hire LegalZoom.

Get Insured

Getting insurance is another important step that you need to complete when forming your LLC. LLCs, by nature, offer limited liability to their owners – in case of a lawsuit or claim, the personal assets of their owners will remain protected. Even though they’re a much more secure option than sole proprietorships and partnerships, it’s still advised for LLC owners to get insured.

There are various types of insurance you can get depending on what your goal is, such as Worker’s Compensation Insurance. To get more information about the insurance guidelines in California, you can check out the California Department of Insurance website.

File Form LLC-12

LLC owners are required to file Form LLC-12 (also known as Statement of Information) every two years after the initial filing. Even though this isn’t technically a step in the formation process, it’s a good idea to keep it in mind so you don’t miss the next deadline and risk getting fined.

FAQs

How Much Does It Cost to Form an LLC in California?

The cost of forming an LLC in California depends on several different factors. If you’re only planning to cover the mandatory formation documents, like filing articles of organization and reserving your business name, the cost of forming an LLC will be around $100. If you add up the insurance costs, initial annual tax, and other optional services, it can cost up to $1,000 to start an LLC in California. Additionally, if you want to add additional costs to that, such as getting a formation package from a company, then the expenses will be higher.

Do I Need to Get an Operating Agreement for my California LLC?

No, it’s not required by law that LLCs in California get an operating agreement. With that said, there are several benefits to doing so, such as preventing future conflict in the workplace and keeping track of the responsibilities of each member.

How Long Does It Take to Start an LLC in California?

The time it takes for you to start your California LLC depends on several different factors, such as how many licenses and permits you’re required to obtain for your business and location. Generally speaking, it will take you two to three months to complete all the steps in the formation process of your LLC.

How Much Is the California LLC Tax?

The cost of filing an annual tax in California is $700. However, depending on what type of business you own, you might have to pay additional taxes. California has taxes on a state and federal level – each business that includes selling certain goods is required to pay a sales tax. Additionally, if your business exceeds an income of $200,000, you will also be required to pay added taxes.

A Word of Farewell

We hope you found our article on how to form an LLC in California informative and that we helped you get a clear idea of what the process of starting an LLC will entail.

There are certain mandatory steps you’ll need to complete, which are a requirement in every state, such as filing articles of organization. We’ve also guided you through some optional steps that can tremendously help your business flourish, like creating an LLC operating agreement.

Leave a Reply