There are many benefits that come with forming an LLC – the owners get to enjoy the perks of liability protection, it’s easier to manage than a corporation, and it comes with certain tax advantages.

Arkansas is one of the states that have adopted the Uniform Limited Liability Company Act, which dictates the governance of Limited Liability Companies. Since this act contains many laws and regulations, figuring out how to form an LLC in Arkansas can be quite confusing.

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

That’s why we decided to create a guide that details all the mandatory and optional steps of creating an LLC in Arkansas. We’ve explained how to complete the abovementioned steps and provided links where you can access everything you need to form your LLC.

In addition, our article also contains a detailed FAQ section at the end, where we answer more important questions, such as the cost of forming an LLC in Arkansas. We’ve also included recommendations for Arkansas registered agents, as well as LLC formation services.

With that out of the way, it’s time to delve into the first step to forming an LLC in Arkansas – finding the right name for it.

Find a Name for Your Arkansas LLC

Before you start filling out all the documents required to start an LLC in Arkansas, you need to decide on what to name your business.

Apart from ensuring that the name you choose meets your personal requirements, like being an accurate representation of your business and your personal values, there are also certain requirements imposed by the state of Arkansas you need to keep in mind.

For starters, your LLC name needs to differentiate from all the other business names in the state of Arkansas. To see if the name you have in mind is available to use, you can do an online business entity search on the Arkansas Secretary of State website.

When you’re certain that your future LLC has a unique name, you can move on to the next step – checking to see if it contains any words which are forbidden in the state, like words that allude to certain government agencies, like FBI and CIA. Keep in mind that there are also certain words you aren’t allowed to use unless you have a special license for your business, such as “attorney” and “lawyer”.

Apart from having restrictions in terms of which words you shouldn’t include in your business name, the state of Arkansas also requires you to add certain words to your business name. You need to include a word that clarifies what kind of business structure you’ve decided on. In the case of LLCs, you can use “Limited Liability Company” or an abbreviation like “LLC” and “L.L.C.”.

Most businesses nowadays require a website. For that reason, during the process of naming your LLC, you should also consider URL availability. Most business owners would benefit from purchasing a domain name during this stage – if you change your mind later down the line, the domain name that corresponds with your business might not be available.

On top of that, many business owners choose to reserve the name they have in mind with the state. You can reserve your business name on the Arkansas Secretary of State website. The state will reserve your name for a total of 120 days while you get all the documents required to form your LLC. The filing fee for a name reservation is $25.

If you’d like to access more information about the naming rules in Arkansas, check out this guideline on the Arkansas Secretary of State website.

Appoint a Registered Agent

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

Appointing a registered agent is an official requirement in most states across the United States. In the state of Arkansas, it’s required by law that you appoint and maintain a registered agent for your business.

A registered agent is a company or an individual who is responsible for receiving and forwarding the documents on your business’s behalf. There are several requirements an entity or an individual need to fulfill before they are recognized as a registered agent, such as being at least 18 years of age, having a physical address in the state of Arkansas, and working during normal business hours. Business owners can choose to appoint themselves or someone they know as their registered agent, but that decision often comes with many drawbacks.

On the other hand, hiring a professional registered agent can provide a plethora of benefits for business owners. For starters, it gives you the opportunity to maintain your privacy, since you won’t be required to share your personal address with the public. Additionally, you can travel without any restrictions and be more flexible with your working hours. Hiring a professional registered agent service also prevents you from facing uncomfortable situations with clients and it will help you maintain a pristine business image.

If you’re not sure which registered agents in Arkansas are worth their salt, here are our top three recommendations.

1. Northwest

One of the most popular choices for entrepreneurs across America, Northwest will ensure that you get all the important compliance tools at a reasonable price. Their registered agent package is comprehensive and includes document storage, mail forwarding, annual report reminders, scanned documents, and access to pre-filled state forms – tools that will undoubtedly keep you from getting fined and getting in trouble with the state. Plus, your data is guaranteed to remain protected thanks to their Privacy by Default practice.

On top of that, customers get to enjoy the benefits of their Corporate Guides – a customer support team comprised of experts across various fields, who will help you solve any issue you might come across.

Northwest’s yearly fee is $125, and you can access an additional discount if you use their services for more than four states.

2. IncFile

If you’re planning on purchasing a formation package to help you in the process of starting an LLC in Arkansas, then we recommend IncFile – every customer who hires them as a formation service will get a complimentary year of registered agent service. This outstanding registered agent service has served over 800,000 customers and is experienced in keeping businesses compliant.

As your registered agent, IncFile will provide automatic mail forwarding, tailored email and text notifications, and access to an online personalized dashboard.

IncFile’s fee will set you back $119 a year.

3. ZenBusiness

Another excellent choice for an Arkansas registered agent is ZenBusiness. Known for being #1 on Forbes, ZenBusiness will give you access to a plethora of benefits, like a personalized dashboard, mail forwarding, email notifications, document scanning, and fast turnaround service. If you like supporting businesses that give back to their community, then you’ll love ZenBusiness’ $5K Grant Program initiative that supports struggling entrepreneurs and helps them start their businesses.

Their fee is $199 a year.

File a Certificate of Organization

A certificate of organization is one of the mandatory formation documents you’ll need to file to officially start your LLC. In some states, this document is referred to as articles of organization. Each state has different requirements in terms of what this document contains, but, generally speaking, you will be asked to include the name of your LLC, its location, the purpose of your business. Additionally, you will be asked to provide information about your registered agent and the members of your LLC.

The certificate of organization needs to be filed with the Arkansas Secretary of State. You can submit the document online or file it via mail. The cost of filing the document online is $50.

Once your document is approved by the state, you will receive an official certificate where your LLC is confirmed as a separate business entity.

Create an Operating Agreement for Your LLC

Unlike a certificate of organization, the state of Arkansas doesn’t require LLC owners to get an operating agreement. It’s an entirely optional step in your LLC formation journey, but it’s one that can provide many benefits to you and your fellow LLC members.

Essentially, an operating agreement is a document that includes basic information about your business, such as its location and duration, but it also states the management structure, the liability clauses, the division of the profits and losses, and the way new members will be accepted.

One of the many reasons having an operating agreement is beneficial is that it can prevent conflict in the workplace. The document clearly states the responsibilities of each member, as well as the division of the profits, so there will be no disputes or misunderstandings in regard to what kind of expectations you have of each other, or any financial disagreements.

File an Annual Franchise Tax Reports

Most states require business owners to file annual reports. Since the Arkansas Corporate Franchise Tax of 1979 was established, Arkansas requires business owners to file an annual franchise report tax. The cost of this process will be around $150. You can file the report online or file it by mail.

Keep in mind that you might be fined if you fail to submit your report on time and pay the necessary fees. Additionally, you risk being barred from operating a business in Arkansas. Some registered agent services include annual report reminders, so if this is a concern for you, you can choose a service that includes them.

Get the Required Business Licenses and Permits

Unlike many other states, Arkansas doesn’t have a general business license on a state level. With that said, you might need to get a professional business license depending on which industry your business is in.

Businesses that sell certain goods and services are required to register for a sales tax permit, the cost of which is $50.

If your business is in a particular sector, like health and food service, you might need to get a special occupational license.

In addition, many licenses vary on a county/municipality level, so we recommend researching your business’ location to determine if there are any other licenses you might be legally obliged to get.

Get an Employer Identification Number

If your LLC has more than one member or if it has employees, you need to obtain an Employee Identification Number. An EIN is like a Social Security Number for your business and it helps the Internal Revenue Service to identify your business for taxation.

If your business isn’t required to get an EIN, you should consider it as an option because it comes with many different benefits. For instance, having an EIN can make it significantly easier for you to open a business bank account or get a loan. Plus, it adds more credibility to your business and it can help your business establish itself as a separate legal entity. Additionally, we recommend getting an EIN because it can help prevent identity theft and make it much easier for you to do your taxes and avoid tax penalties.

You can obtain an EIN by submitting an online application on the IRS website. Applying for an EIN doesn’t have a filing fee.

Purchase a Formation Service

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

If the process of starting an LLC seems daunting to you and you’d like some additional help from experienced professionals, don’t hesitate to purchase a formation package. Many companies, typically those that offer a registered agent service, offer comprehensive LLC formation packages that are guaranteed to make this process not only easier but much quicker.

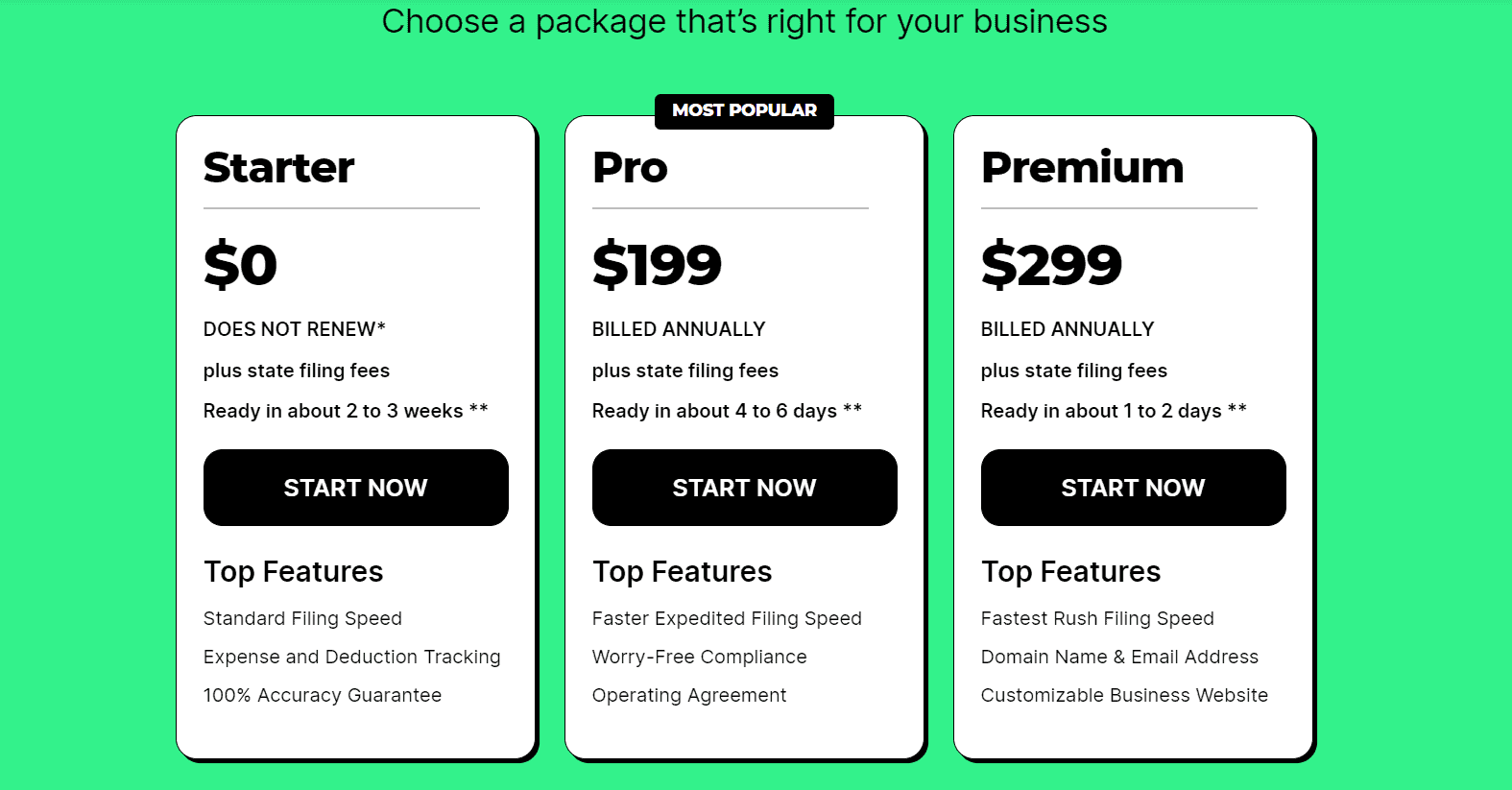

There are some companies that even offer to do it free of charge, such as ZenBusiness. Their Starter Formation Package is completely free of charge, excluding the necessary state filing fees. They offer expense and deduction tracking, a standard filing speed, and a 100% accuracy guarantee. Plus, they promise to have all of this ready in two to three weeks.

Apart from that, they also offer a Pro Formation Package ($199) that comes with an operating agreement, expedited filing speed, and worry-free compliance, as well as a Premium Formation Package that includes an incredibly fast filing speed, domain name and email address, and even a business website. Their Premium Formation Package will set you back $299 a year, but you’ll have all of it ready in one to two days! It’s a great option for those who want their LLC to be formed as fast as possible.

Another excellent company that offers a comprehensive formation package is MyCompanyWorks. With their formation package, they promise to handle all the basics of LLC formation, such as filing the mandatory documents with the state and providing you with all the paperwork that you might need, such as an operating agreement and a Startup Checklist. Additionally, every customer gets access to their Startup Wizard – an interactive tool that provides a personalized approach and guides you through all the steps of setting up your LLC. Their fees are $59 plus state fees.

FAQs

How Much Does It Cost to Form an LLC in Arkansas?

The cost of forming an LLC in Arkansas depends on whether you’re planning on completing all the steps by yourself or hiring a helping hand, whether that’s a consultant or purchasing a formation package. In terms of the cost of filing the necessary documents, filing a certificate of organization will set you back $50. An optional additional service like name reservation will cost you $25. When it comes to maintenance costs, you’ll be required to pay a $150 annual franchise tax to the state.

Can I Be My Own Registered Agent in Arkansas?

Yes, the state of Arkansas allows LLC owners to act as their own registered agent. However, this choice comes with various drawbacks, such as a lack of privacy, so we recommend hiring a professional service.

Is an Operating Agreement Required in Arkansas?

In Arkansas, LLCs aren’t legally required to create an operating agreement during the formation process. However, doing so can result in many different benefits, such as preventing future conflicts between members and having a clear agreement on the liability clauses. It’s a relatively easy step that can save you a lot of headaches in the future.

A Word of Farewell

We hope you found our guide on how to form an LLC in Arkansas informative and that we brought you one step closer to opening your business in this state.

Forming an LLC in Arkansas is a relatively affordable and straightforward process, however, if you’re short on time or you’d just want to get some additional help, you can always opt for hiring a formation service. Keep in mind that to file all the necessary documents with the state, you’ll also need to appoint a registered agent for your LLC.

Leave a Reply