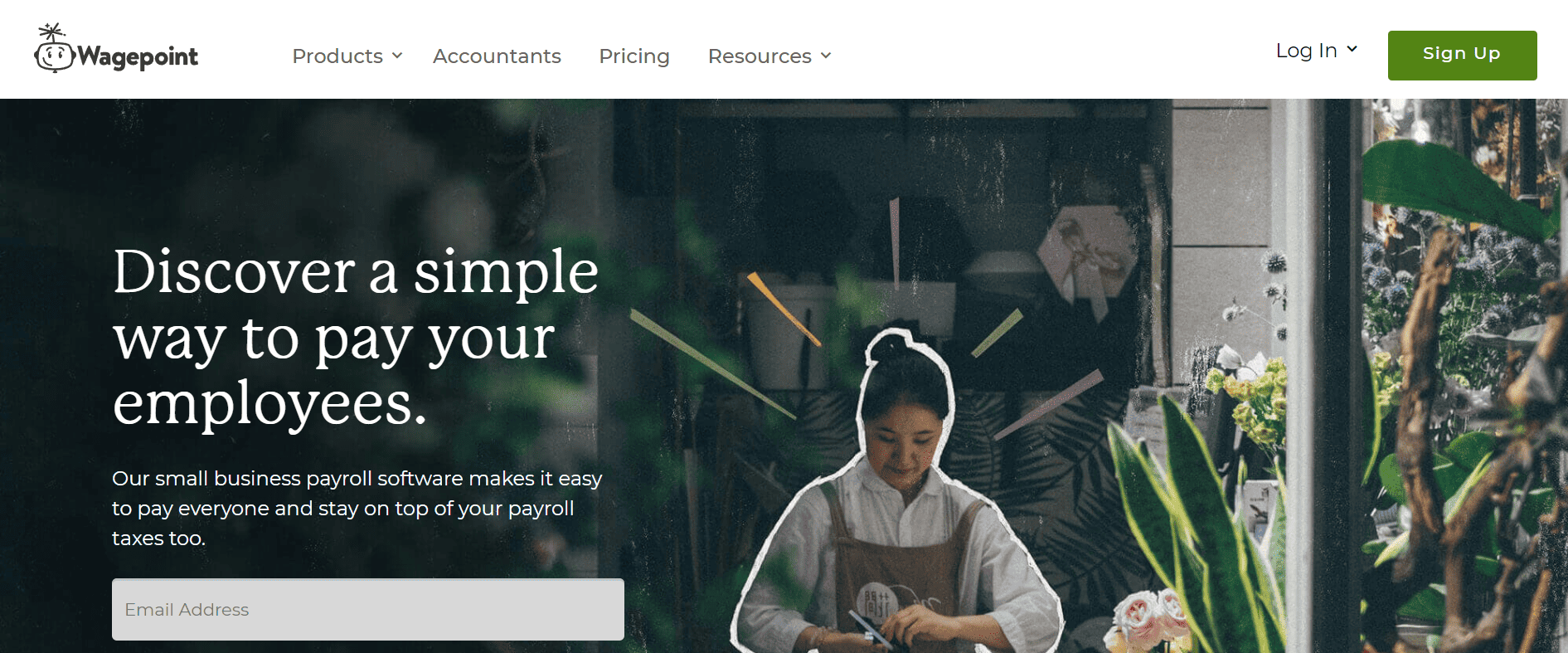

Want to know if Wagepoint is the right payroll software solution for your business?

Then have a look at the user created reviews below or better yet help out other business owners and leave your own.

Wagepoint User Reviews

Wagepoint Review Summary

0.0 out of 5 stars (based on 0 reviews)

Recent Wagepoint Reviews

There are no reviews yet. Be the first one to write one.

Submit a review for Wagepoint

Other Remote Reviews

| Website | Review Score | Number of Reviews |

|---|---|---|

| Trustpilot | 4.5 | 237 |

| iPhone App | – | – |

| Android App | – | – |

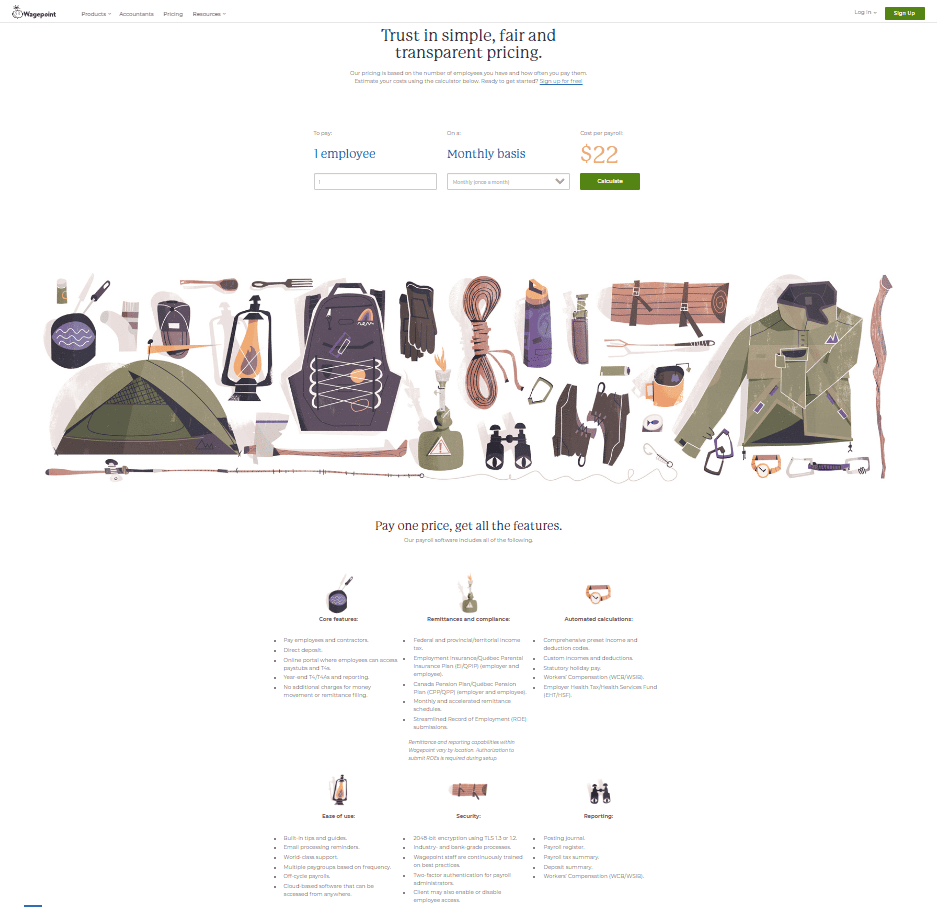

Wagepoint Cost & Pricing

| Plans | Pricing |

|---|---|

| Free Trial? | n/a |

| Free Trial Length | n/a |

| Cheapest Plan: Cost per payroll | $22/month |

| Middle Plan: n/a | n/a/month |

| Top Plan: n/a | n/a/month |

Wagepoint Features

Cheapest Plan: Cost per payroll Features

- Pay employees and contractors.

- Direct deposit.

- Online portal where employees can access paystubs and T4s.

- Year-end T4/T4As and reporting.

- No additional charges for money movement or remittance filing.

- Federal and provincial/territorial income tax.

- Employment Insurance/Québec Parental Insurance Plan (EI/QPIP) (employer and employee).

- Canada Pension Plan/Québec Pension Plan (CPP/QPP) (employer and employee).

- Monthly and accelerated remittance schedules.

- Streamlined Record of Employment (ROE) submissions.

- Comprehensive preset income and deduction codes.

- Custom incomes and deductions.

- Statutory holiday pay.

- Workers’ Compensation (WCB/WSIB).

- Employer Health Tax/Health Services Fund (EHT/HSF).

- Built-in tips and guides.

- Email processing reminders.

- World-class support.

- Multiple paygroups based on frequency.

- Off-cycle payrolls.

- Cloud-based software that can be accessed from anywhere.

- 2048-bit encryption using TLS 1.3 or 1.2.

- Industry- and bank-grade processes.

- Wagepoint staff are continuously trained on best practices.

- Two-factor authentication for payroll administrators.

- Client may also enable or disable employee access.

- Posting journal.

- Payroll register.

- Payroll tax summary.

- Deposit summary.

- Workers’ Compensation (WCB/WSIB).

Middle Plan: n/a Features

n/a

Top Plan: n/a Features

n/a

Availability of Common Features

| Feature | Available |

|---|---|

| Ideal Business Size | Small business |

| Unlimited Payrolls | No |

| Automated Tax Filing and Payments | Yes |

| E-sign I-9 and W-4 | No |

| Live Customer Support | No |

| Integrations | Yes |

| Ability to manage employee benefits | No |

| Employee access to platform | Yes |

| Direct Deposit | Yes |

| Expense Reimbursement | Yes |

| Time Off Accrual | Yes |

| Pre-tax Deductions | Yes |

| Wage Garnishment | Yes |

| Background Checks | No |

| Check Printing | Yes |

| Check Delivery | No |

| API | No |

Wagepoint Pros & Cons

Pros

- User-friendly setup

- Customer service

- Affordability

Cons

- Limited accounting software integrations

- Poor PTO and time-tracking tools

- No HR tools or HCM-adjacent features

- No mobile payroll app

Leave a Reply