Both Remote and Workday are leading payroll software solutions, but which one is better for you and your business?

Below we compare Remote and Workday across nearly 50 different data points to help you make find the right one.

Remote vs Workday Reviews

| Remote | Workday | ||

| Trustpilot Rating | 4.6 | 1.1 | |

| Number of Trustpilot Reviews | 1109 | 178 | |

| iPhone App Rating | 5 | 4.7 | |

| Number of iPhone App Reviews | 7 | 878800 | |

| Android App Rating | 4.3 | 4.5 | |

| Number of Android App Reviews | 32 | 120000 |

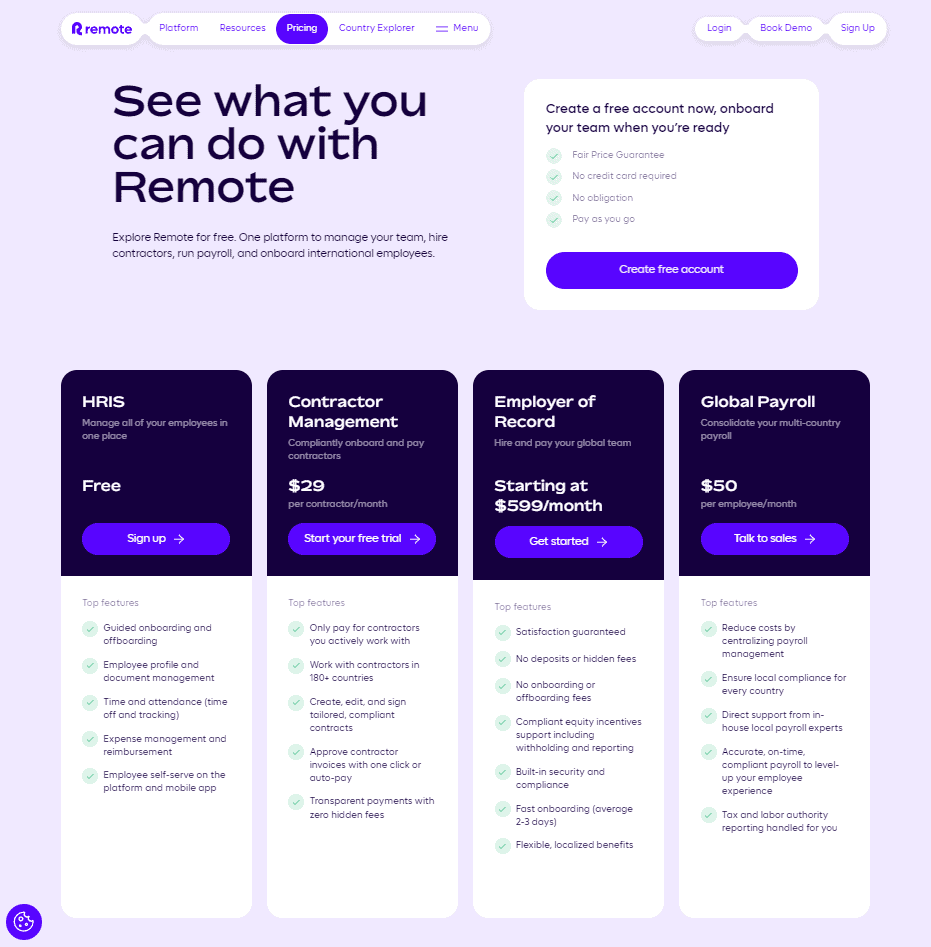

Remote vs Workday Pricing

| Remote | Workday | |

| Free Trial | Yes | n/a |

| Free Trial Length | n/a | n/a |

| Cheapest Plan Name | Contractor Management | n/a |

| Cheapest Plan Cost Per Month | $50 | $n/a |

| Mid Priced Plan Name | Global Payroll | n/a |

| Mid Priced Plan Cost Per Month | $50 | $n/a |

| Top Plan Name | Employer of Record | n/a |

| Top Plan Cost Per Month | $599 | $n/a |

Remote vs Workday Features

| Features | Remote | Workday |

| Target Business Size | Enterprise | Enterprise |

| Unlimited Payrolls | ✘ | ✘ |

| Automated Tax Filing & Payments | ✔ | ✘ |

| E-sign I-9 & W-4 | ✘ | ✘ |

| Live Customer Support | ✔ | ✘ |

| Third-Party Integrations | ✔ | ✔ |

| Ability To Manage Employee Benefits | ✔ | ✔ |

| Employee Access To Platform | ✔ | ✔ |

| Direct Deposit | ✔ | ✔ |

| Expense Reimbursement | ✔ | ✔ |

| Time Off Accrual | ✔ | ✔ |

| Pre-Tax Deductions | ✔ | ✔ |

| Wage Garnishment | ✔ | ✔ |

| Background Checks | ✘ | ✔ |

| Check Printing | ✔ | ✔ |

| Check Delivery | ✘ | ✘ |

| API | ✔ | ✔ |

Remote Contractor Management Features

- Only pay for contractors you actively work with

- Work with contractors in 180+ countries

- Create, edit, and sign tailored, compliant contracts

- Approve contractor invoices with one click or auto-pay

- Transparent payments with zero hidden fees

Workday n/a Features

n/a

Remote Employer of Record Features

- Satisfaction guaranteed

- No deposits or hidden fees

- No onboarding or offboarding fees

- Compliant equity incentives support including withholding and reporting

- Built-in security and compliance

- Fast onboarding (average 2-3 days)

- Flexible, localized benefits

Workday n/a Features

n/a

Remote vs Workday Pro & Cons

| Remote | Workday | |

| Pros |

|

|

| Cons |

|

|