Want to know if QuickBooks Payroll is the right payroll software solution for your business?

Then have a look at the user created reviews below or better yet help out other business owners and leave your own.

QuickBooks Payroll User Reviews

QuickBooks Payroll Review Summary

0.0 out of 5 stars (based on 0 reviews)

Recent QuickBooks Payroll Reviews

There are no reviews yet. Be the first one to write one.

Submit a review for QuickBooks Payroll

Other Remote Reviews

| Website | Review Score | Number of Reviews |

|---|---|---|

| Trustpilot | 1.1 | 551 |

| iPhone App | 4.6 | 110,400 |

| Android App | 4.1 | 29,900 |

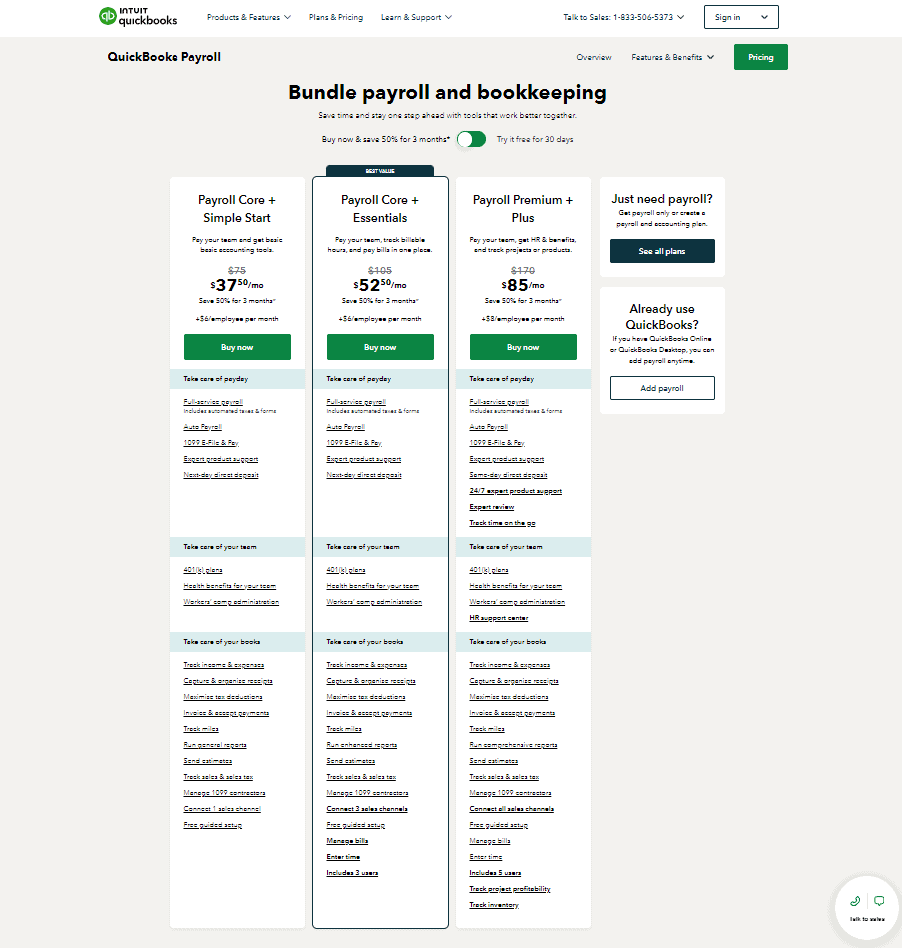

QuickBooks Payroll Cost & Pricing

| Plans | Pricing |

|---|---|

| Free Trial? | Yes |

| Free Trial Length | 1 month |

| Cheapest Plan: Payroll Core + Simple Start | $37.50/month |

| Middle Plan: Payroll Core + Essentials | $52.50/month |

| Top Plan: Payroll Premium + Plus | $85/month |

QuickBooks Payroll Features

Cheapest Plan: Payroll Core + Simple Start Features

- Full-service payroll

- Includes automated taxes & forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Next-day direct deposit

- 401(k) plans

- Health benefits for your team

- Workers’ comp administration

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Run general reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Connect 1 sales channel

- Free guided setup

Middle Plan: Payroll Core + Essentials Features

- Full-service payroll

- Includes automated taxes & forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Next-day direct deposit

- 401(k) plans

- Health benefits for your team

- Workers’ comp administration

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Run enhanced reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Connect 3 sales channels

- Free guided setup

- Manage bills

- Enter time

- Includes 3 users

- Enter time

- Includes 3 users

Top Plan: Payroll Premium + Plus Features

- Full-service payroll

- Includes automated taxes & forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Same-day direct deposit

- 24/7 expert product support

- Expert review

- Track time on the go

- 401(k) plans

- Health benefits for your team

- Workers’ comp administration

- HR support center

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Run comprehensive reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Connect all sales channels

- Free guided setup

- Manage bills

- Enter time

- Includes 5 users

- Track project profitability

- Track inventory

Availability of Common Features

| Feature | Available |

|---|---|

| Ideal Business Size | Mid size business |

| Unlimited Payrolls | No |

| Automated Tax Filing and Payments | Yes |

| E-sign I-9 and W-4 | No |

| Live Customer Support | Yes |

| Integrations | Yes |

| Ability to manage employee benefits | Yes |

| Employee access to platform | Yes |

| Direct Deposit | Yes |

| Expense Reimbursement | Yes |

| Time Off Accrual | Yes |

| Pre-tax Deductions | Yes |

| Wage Garnishment | Yes |

| Background Checks | No |

| Check Printing | Yes |

| Check Delivery | No |

| API | No |

QuickBooks Payroll Pros & Cons

Pros

- User Friendly

- User Interface

- Saves Time

- Access Anywhere

- Meets Business Needs

Cons

- Room for Improvement

- Takes Time

- Customer Service

- Expensive

- Desktop Issues

Leave a Reply