Both Paychex and QuickBooks Payroll are leading payroll software solutions, but which one is better for you and your business?

Below we compare Paychex and QuickBooks Payroll across nearly 50 different data points to help you make find the right one.

Paychex vs QuickBooks Payroll Reviews

| Paychex | QuickBooks Payroll | ||

| Trustpilot Rating | 1.2 | 1.1 | |

| Number of Trustpilot Reviews | 233 | 551 | |

| iPhone App Rating | 4.8 | 4.6 | |

| Number of iPhone App Reviews | 411200 | 110400 | |

| Android App Rating | 3.8 | 4.1 | |

| Number of Android App Reviews | 29400 | 29900 |

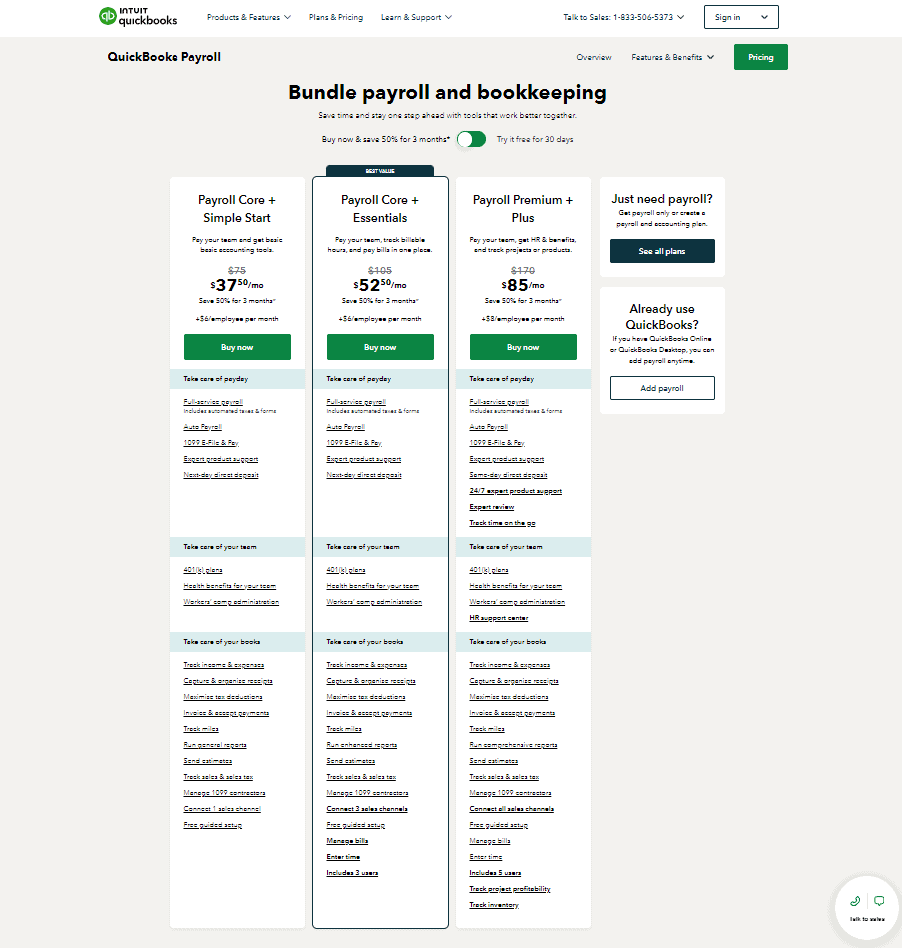

Paychex vs QuickBooks Payroll Pricing

| Paychex | QuickBooks Payroll | |

| Free Trial | n/a | Yes |

| Free Trial Length | n/a | 1 month |

| Cheapest Plan Name | Essentials | Payroll Core + Simple Start |

| Cheapest Plan Cost Per Month | $By request | $52.5 |

| Mid Priced Plan Name | Select | Payroll Core + Essentials |

| Mid Priced Plan Cost Per Month | $By request | $52.5 |

| Top Plan Name | Pro | Payroll Premium + Plus |

| Top Plan Cost Per Month | $By request | $85 |

Paychex vs QuickBooks Payroll Features

| Features | Paychex | QuickBooks Payroll |

| Target Business Size | Enterprise | Mid size business |

| Unlimited Payrolls | ✘ | ✘ |

| Automated Tax Filing & Payments | ✔ | ✔ |

| E-sign I-9 & W-4 | ✘ | ✘ |

| Live Customer Support | ✘ | ✔ |

| Third-Party Integrations | ✔ | ✔ |

| Ability To Manage Employee Benefits | ✔ | ✔ |

| Employee Access To Platform | ✔ | ✔ |

| Direct Deposit | ✔ | ✔ |

| Expense Reimbursement | ✘ | ✔ |

| Time Off Accrual | ✔ | ✔ |

| Pre-Tax Deductions | ✔ | ✔ |

| Wage Garnishment | ✔ | ✔ |

| Background Checks | ✔ | ✘ |

| Check Printing | ✔ | ✔ |

| Check Delivery | ✔ | ✘ |

| API | ✔ | ✘ |

Paychex Essentials Features

- Payroll Processing

- Taxpay® Payroll Tax Administration with W-2/1099

- Employee Pay Options

- Garnishment Payment Service

- Employee Self-Service and Mobile Experience

- Financial Wellness and Cashflow Assistance

- Employee Onboarding

- HR Library

- Analytics and Reports Center

- New Hire Reporting

- Labor Posters

QuickBooks Payroll Payroll Core + Simple Start Features

- Full-service payroll

- Includes automated taxes & forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Next-day direct deposit

- 401(k) plans

- Health benefits for your team

- Workers’ comp administration

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Run general reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Connect 1 sales channel

- Free guided setup

Paychex Pro Features

- Payroll Processing

- Taxpay® Payroll Tax Administration with W-2/1099

- Employee Pay Options

- Garnishment Payment Service

- General Ledger Service

- Employee Self-Service and Mobile Experience

- Financial Wellness and Cashflow Assistance

- Learning Management System1

- Employee Onboarding

- HR Library

- Employee Handbook Builder

- Pre-Employment Screening

- Analytics and Reports Center

- New Hire Reporting

- Labor Posters

- State Unemployment Insurance Service

- Workers’ Compensation Payment Service2 or Report Service

- General Ledger Integrations

QuickBooks Payroll Payroll Premium + Plus Features

- Full-service payroll

- Includes automated taxes & forms

- Auto Payroll

- 1099 E-File & Pay

- Expert product support

- Same-day direct deposit

- 24/7 expert product support

- Expert review

- Track time on the go

- 401(k) plans

- Health benefits for your team

- Workers’ comp administration

- HR support center

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Run comprehensive reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Connect all sales channels

- Free guided setup

- Manage bills

- Enter time

- Includes 5 users

- Track project profitability

- Track inventory

Paychex vs QuickBooks Payroll Pro & Cons

| Paychex | QuickBooks Payroll | |

| Pros |

|

|

| Cons |

|

|