Both Microkeeper and Wagepoint are leading payroll software solutions, but which one is better for you and your business?

Below we compare Microkeeper and Wagepoint across nearly 50 different data points to help you make find the right one.

Microkeeper vs Wagepoint Reviews

| Microkeeper | Wagepoint | ||

| Trustpilot Rating | 3.6 | 4.5 | |

| Number of Trustpilot Reviews | 96 | 237 | |

| iPhone App Rating | 4.4 | 0 | |

| Number of iPhone App Reviews | 111 | 0 | |

| Android App Rating | 0 | 0 | |

| Number of Android App Reviews | 0 | 0 |

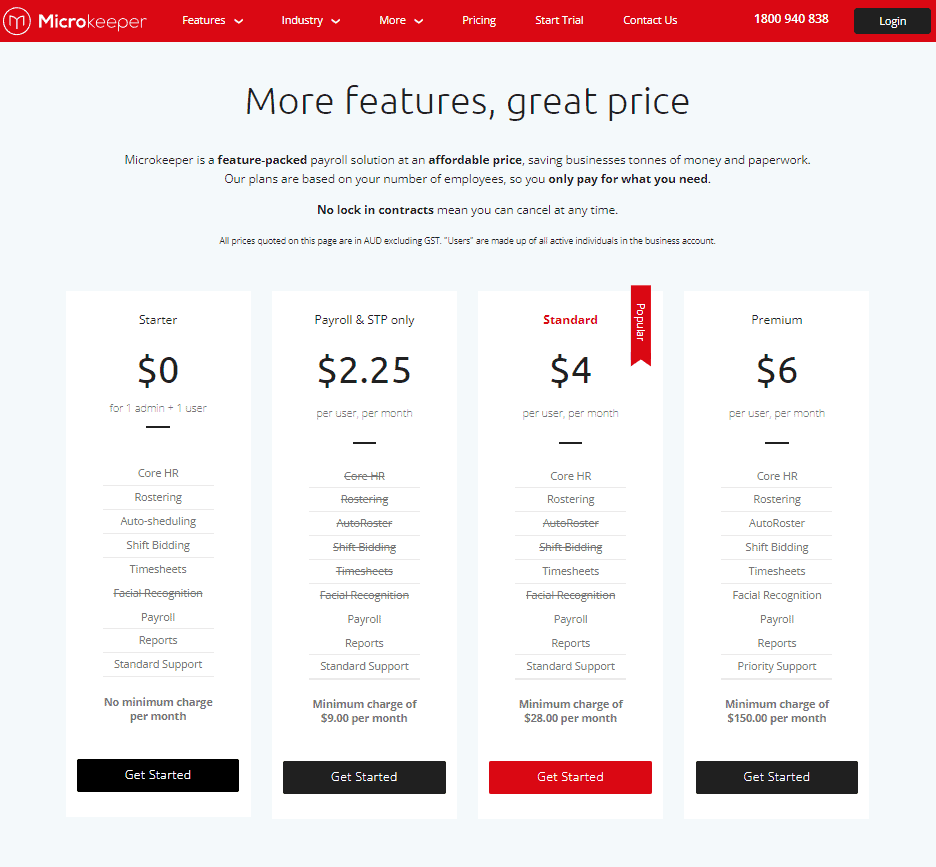

Microkeeper vs Wagepoint Pricing

| Microkeeper | Wagepoint | |

| Free Trial | Yes | n/a |

| Free Trial Length | 1 month | n/a |

| Cheapest Plan Name | Payroll & STP only | Cost per payroll |

| Cheapest Plan Cost Per Month | $28 | $n/a |

| Mid Priced Plan Name | Standard | n/a |

| Mid Priced Plan Cost Per Month | $28 | $n/a |

| Top Plan Name | Premium | n/a |

| Top Plan Cost Per Month | $150 | $n/a |

Microkeeper vs Wagepoint Features

| Features | Microkeeper | Wagepoint |

| Target Business Size | Enterprise | Small business |

| Unlimited Payrolls | ✘ | ✘ |

| Automated Tax Filing & Payments | ✘ | ✔ |

| E-sign I-9 & W-4 | ✘ | ✘ |

| Live Customer Support | ✘ | ✘ |

| Third-Party Integrations | ✔ | ✔ |

| Ability To Manage Employee Benefits | ✔ | ✘ |

| Employee Access To Platform | ✔ | ✔ |

| Direct Deposit | ✔ | ✔ |

| Expense Reimbursement | ✘ | ✔ |

| Time Off Accrual | ✔ | ✔ |

| Pre-Tax Deductions | ✔ | ✔ |

| Wage Garnishment | ✔ | ✔ |

| Background Checks | ✘ | ✘ |

| Check Printing | ✔ | ✔ |

| Check Delivery | ✘ | ✘ |

| API | ✔ | ✘ |

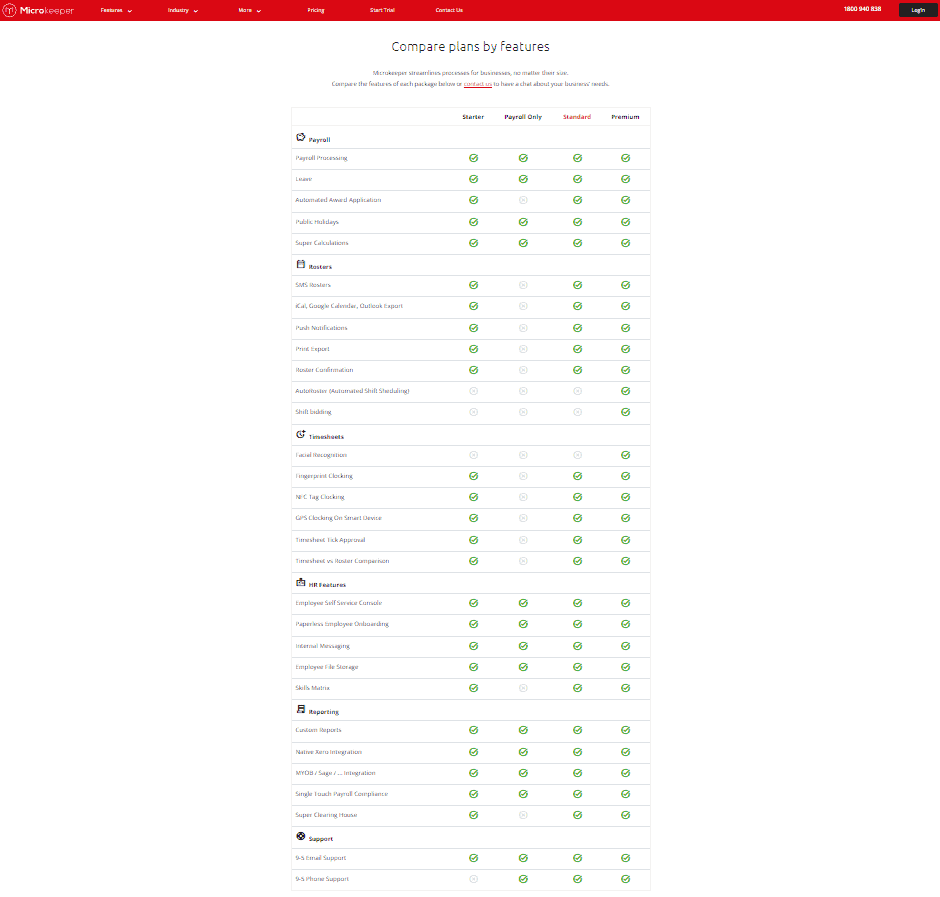

Microkeeper Payroll & STP only Features

- Payroll Processing

- Leave

- Public Holidays

- Super Calculations

- Employee Self Service Console

- Paperless Employee Onboarding

- Internal Messaging

- Employee File Storage

- Custom Reports

- Native Xero Integration

- MYOB / Sage / … Integration

- Single Touch Payroll Compliance

- 9-5 Email Support

- 9-5 Phone Support

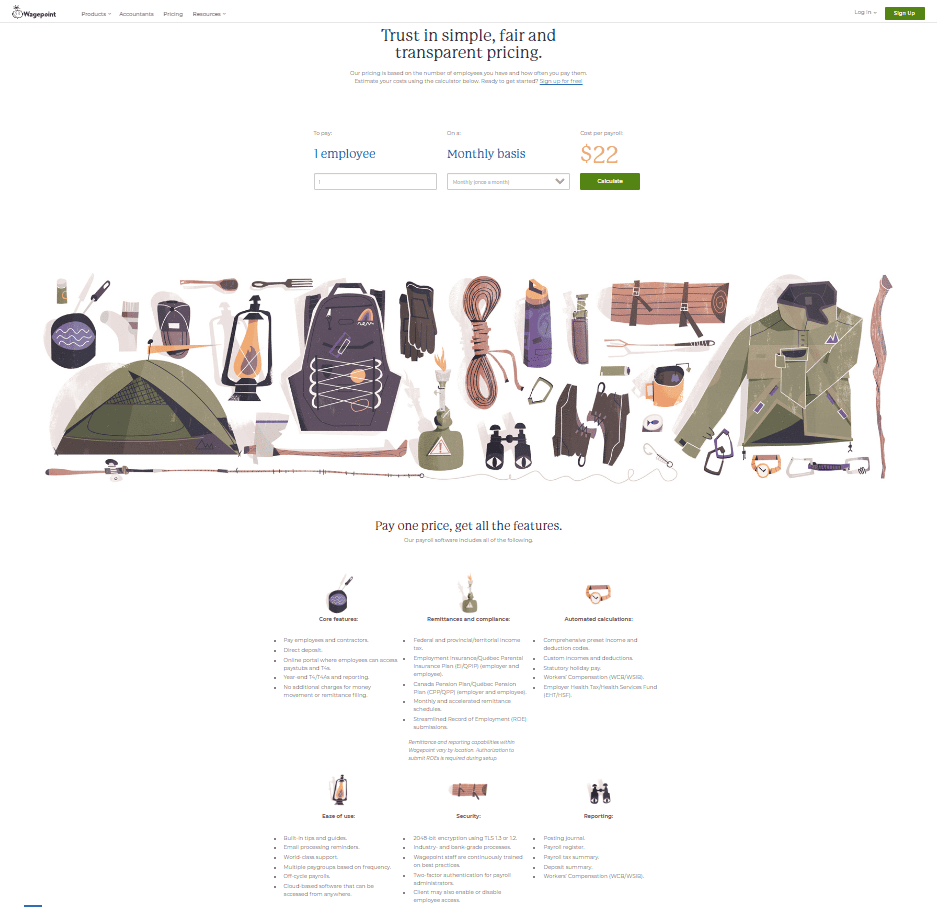

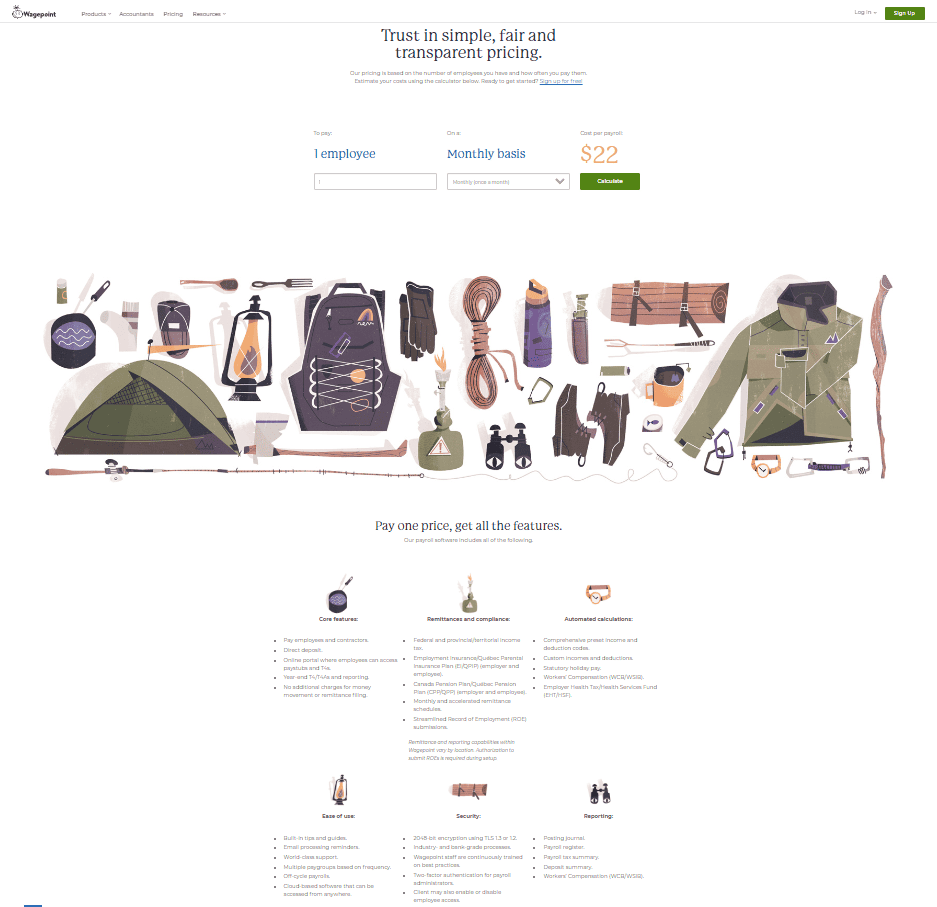

Wagepoint Cost per payroll Features

- Pay employees and contractors.

- Direct deposit.

- Online portal where employees can access paystubs and T4s.

- Year-end T4/T4As and reporting.

- No additional charges for money movement or remittance filing.

- Federal and provincial/territorial income tax.

- Employment Insurance/Québec Parental Insurance Plan (EI/QPIP) (employer and employee).

- Canada Pension Plan/Québec Pension Plan (CPP/QPP) (employer and employee).

- Monthly and accelerated remittance schedules.

- Streamlined Record of Employment (ROE) submissions.

- Comprehensive preset income and deduction codes.

- Custom incomes and deductions.

- Statutory holiday pay.

- Workers’ Compensation (WCB/WSIB).

- Employer Health Tax/Health Services Fund (EHT/HSF).

- Built-in tips and guides.

- Email processing reminders.

- World-class support.

- Multiple paygroups based on frequency.

- Off-cycle payrolls.

- Cloud-based software that can be accessed from anywhere.

- 2048-bit encryption using TLS 1.3 or 1.2.

- Industry- and bank-grade processes.

- Wagepoint staff are continuously trained on best practices.

- Two-factor authentication for payroll administrators.

- Client may also enable or disable employee access.

- Posting journal.

- Payroll register.

- Payroll tax summary.

- Deposit summary.

- Workers’ Compensation (WCB/WSIB).

Microkeeper Premium Features

- Payroll Processing

- Leave

- Automated Award Application

- Public Holidays

- Super Calculations

- SMS Rosters

- iCal, Google Calendar, Outlook Export

- Push Notifications

- Print Export

- Roster Confirmation

- AutoRoster (Automated Shift Sheduling)

- Shift bidding

- Facial Recognition

- Fingerprint Clocking

- NFC Tag Clocking

- GPS Clocking On Smart Device

- Timesheet Tick Approval

- Timesheet vs Roster Comparison

- Employee Self Service Console

- Paperless Employee Onboarding

- Internal Messaging

- Employee File Storage

- Skills Matrix

- Custom Reports

- Native Xero Integration

- MYOB / Sage / … Integration

- Single Touch Payroll Compliance

- Super Clearing House

- 9-5 Email Support

- 9-5 Phone Support

Wagepoint n/a Features

n/a

Microkeeper vs Wagepoint Pro & Cons

| Microkeeper | Wagepoint | |

| Pros |

|

|

| Cons |

|

|