Both Deel and Wagepoint are leading payroll software solutions, but which one is better for you and your business?

Below we compare Deel and Wagepoint across nearly 50 different data points to help you make find the right one.

Deel vs Wagepoint Reviews

| Deel | Wagepoint | ||

| Trustpilot Rating | 4.8 | 4.5 | |

| Number of Trustpilot Reviews | 2855 | 237 | |

| iPhone App Rating | not available | 0 | |

| Number of iPhone App Reviews | not available | 0 | |

| Android App Rating | not available | 0 | |

| Number of Android App Reviews | not available | 0 |

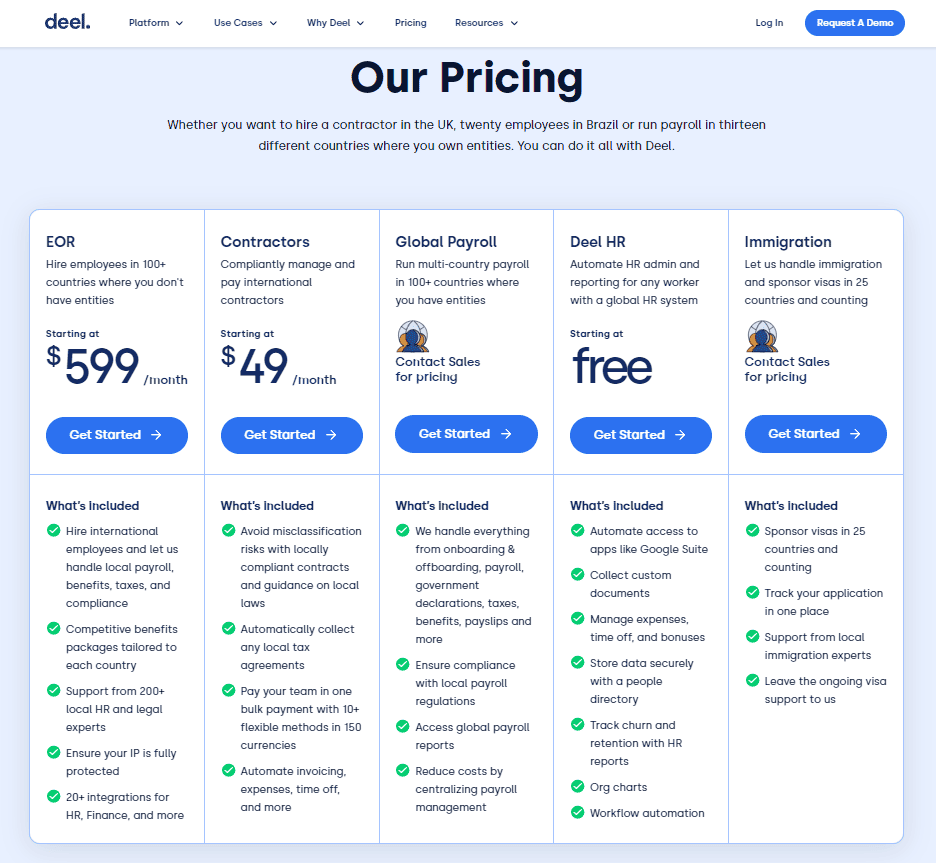

Deel vs Wagepoint Pricing

| Deel | Wagepoint | |

| Free Trial | n/a | n/a |

| Free Trial Length | n/a | n/a |

| Cheapest Plan Name | Contractors | Cost per payroll |

| Cheapest Plan Cost Per Month | $n/a | $n/a |

| Mid Priced Plan Name | n/a | n/a |

| Mid Priced Plan Cost Per Month | $n/a | $n/a |

| Top Plan Name | EOR | n/a |

| Top Plan Cost Per Month | $599 | $n/a |

Deel vs Wagepoint Features

| Features | Deel | Wagepoint |

| Target Business Size | Enterprise | Small business |

| Unlimited Payrolls | ✘ | ✘ |

| Automated Tax Filing & Payments | ✘ | ✔ |

| E-sign I-9 & W-4 | ✔ | ✘ |

| Live Customer Support | ✘ | ✘ |

| Third-Party Integrations | ✔ | ✔ |

| Ability To Manage Employee Benefits | ✔ | ✘ |

| Employee Access To Platform | ✔ | ✔ |

| Direct Deposit | ✔ | ✔ |

| Expense Reimbursement | ✔ | ✔ |

| Time Off Accrual | ✔ | ✔ |

| Pre-Tax Deductions | ✔ | ✔ |

| Wage Garnishment | ✔ | ✔ |

| Background Checks | ✘ | ✘ |

| Check Printing | ✘ | ✔ |

| Check Delivery | ✘ | ✘ |

| API | ✔ | ✘ |

Deel Contractors Features

- Avoid misclassification risks with locally compliant contracts and guidance on local laws

- Automatically collect any local tax agreements

- Pay your team in one bulk payment with 10+ flexible methods in 150 currencies

- Automate invoicing, expenses, time off, and more

Wagepoint Cost per payroll Features

- Pay employees and contractors.

- Direct deposit.

- Online portal where employees can access paystubs and T4s.

- Year-end T4/T4As and reporting.

- No additional charges for money movement or remittance filing.

- Federal and provincial/territorial income tax.

- Employment Insurance/Québec Parental Insurance Plan (EI/QPIP) (employer and employee).

- Canada Pension Plan/Québec Pension Plan (CPP/QPP) (employer and employee).

- Monthly and accelerated remittance schedules.

- Streamlined Record of Employment (ROE) submissions.

- Comprehensive preset income and deduction codes.

- Custom incomes and deductions.

- Statutory holiday pay.

- Workers’ Compensation (WCB/WSIB).

- Employer Health Tax/Health Services Fund (EHT/HSF).

- Built-in tips and guides.

- Email processing reminders.

- World-class support.

- Multiple paygroups based on frequency.

- Off-cycle payrolls.

- Cloud-based software that can be accessed from anywhere.

- 2048-bit encryption using TLS 1.3 or 1.2.

- Industry- and bank-grade processes.

- Wagepoint staff are continuously trained on best practices.

- Two-factor authentication for payroll administrators.

- Client may also enable or disable employee access.

- Posting journal.

- Payroll register.

- Payroll tax summary.

- Deposit summary.

- Workers’ Compensation (WCB/WSIB).

Deel EOR Features

- Hire international employees and let us handle local payroll, benefits, taxes, and compliance

- Competitive benefits packages tailored to each country

- Support from 200+ local HR and legal experts

- Ensure your IP is fully protected

- 20+ integrations for HR, Finance, and more

Wagepoint n/a Features

n/a

Deel vs Wagepoint Pro & Cons

| Deel | Wagepoint | |

| Pros |

|

|

| Cons |

|

|