Starting an LLC in Alabama might seem like a challenging task, but with the right research and strategy, anyone can do it. If you’ve ever wondered how to form an LLC in Alabama, you’ve come to the right place.

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

In our guide, we’ll explore every step required to form an LLC in Alabama and all the optional steps that might make this process significantly easier. At the end of our guide, we’ve included some of our formation package recommendations, in case you want additional help, as well as an FAQ section.

With that said, let’s start by delving into all the steps required to form an LLC in Alabama.

How to Start an LLC in Alabama

Find a Name for Your Alabama LLC

The first step to forming an LLC in Alabama is choosing its name simply because it’ll be included in every formation document, like a certificate of formation.

A key rule to keep in mind is that your business name is required to be unique and distinguishable from all other business names in the state of Alabama. To ensure that this is the case, you can do an online business entity search on the Alabama Secretary of State website.

Moreover, Alabama law dictates that your LLC name must contain a word that denotes the business structure – in this case, a Limited Liability Company. You can use the full term, or opt for an abbreviation, such as “LLC” or “L.L.C.”.

If you don’t want to use your legal name for your business, you have the option of using a DBA (Doing Business As) name or a trade name. To start using a DBA name, you need to apply to register a trade name with the Alabama Secretary of State. The filing fee for a DBA name application is $30.

If you want, you can also submit a name reservation request to the Alabama Secretary of State to ensure that nobody grabs hold of your business name while you’re preparing the necessary documents. The filing fee is $25.

Get a Registered Agent

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

The next step to forming your Alabama LLC is choosing what registered agent will represent your business.

All LLCs and corporations in the state of Alabama are required to appoint a registered agent. A registered agent is a company or an individual whose main task is to receive all legal correspondence and documents on your business’ behalf and forward those documents to you in a timely manner. There are several requirements a registered agent needs to fulfil to be qualified to represent your business, such as being over 18 years of age, being an Alabama resident, and operating during normal business hours.

While you have the option of appointing yourself or a family member as your registered agent, we highly recommend hiring a professional registered agent service. Doing so results in many benefits, such as giving you more free time to dedicate to your business and having flexible business hours.

Some of the best Alabama registered agent services are Northwest, IncFile, and ZenBusiness. These companies will give you access to various different tools that will help you keep compliant with Alabama’s laws, such as mail forwarding, access to an online account, and annual report reminders.

Once you have decided which registered agent will represent your business, it’s time to move on to the next step – filing the necessary certificate of formation.

File a Certificate of Formation

Every LLC in Alabama is required to file a certificate of formation with the state.

In this document, you’ll be required to provide information about your LLC, such as its name, location, and type. You’ll also be asked to provide some personal information, as well as information about your registered agent.

The cost of filing a certificate of formation in Alabama is $200.

Create an Operating Agreement

While it’s not a mandatory step, LLC owners in Alabama have the option of creating an operating agreement for their business.

An operating agreement is a document that provides information on how you’ll operate your LLC. It’s an extremely useful document, especially for avoiding future conflicts with your partners. It’ll provide all the ground rules and enlist all the responsibilities of each member, so there are no misunderstandings in the future.

You can hire a professional company to form your operating agreement, such as Northwest, you can put it together on your own, or you can search for a free online template.

Fulfill All the Alabama Tax Requirements

Apart from filing a certificate of formation, Alabama LLC owners are required to file a Business Privilege Tax Return. The tax percentage depends on your total income. You can find more tax-related information on the Alabama Department of Revenue website.

Another requirement you’ll have to fulfill is submitting a yearly report to the Alabama Department of Revenue. The filing fee is $10.

Get an Employer Identification Number

Whether or not your business is required by law to have an Employee Identification Number depends on whether you have hired employees for your business and how your business is taxed. If your business is taxed as a separate entity from you, you’ll be required by law to get an EIN.

The EIN application is conducted on the IRS website. The application is online and free of charge.

Even if you own a business that’s not required to get an EIN, there are several benefits that come with getting one. For instance, it can help prevent identity theft, it can help qualify you for a retirement plan, and make it significantly easier for you to open a business bank account, so we recommend considering it as an option.

Get all the Required Licenses and Permits

In Alabama, all businesses are required to purchase a Business Privilege License.

Additionally, if your business entails selling certain goods and products, you might have to apply for a Sales and Use Tax on the Alabama Department of Revenue Website.

Keep in mind that some licenses vary on a county and local level, so check with your county or city to ensure that you have all the required licenses for your business.

Hire an Agent to Help You Form Your LLC

- Packages from $0 + State Filling Fees

- Start an LLC, C-Corp, S-Corp or Non-profit

- Available in all 50 states!

- Free compliance reminders

- No hidden cost business formation

- No long-term contracts and subscriptions

- 1 Free Year of Registered Agent Service

- Free Domain, Website, Email & Phone

- In business since 1998!

- Business Address & Free Mail Forwarding

- Fast LLC Filing

- Privacy by Default

If you think you might need help forming your LLC, you can always hire a professional company to do all the hard work for you. There are some companies that provide basic LLC formation packages entirely free of charge.

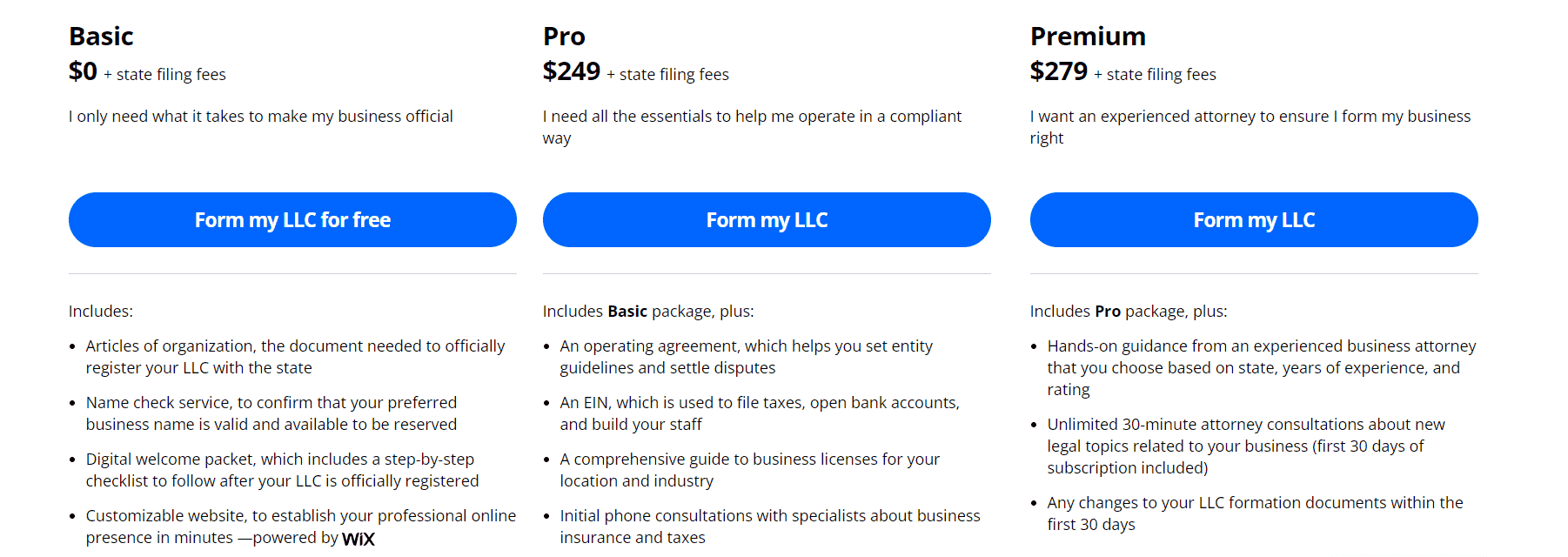

For instance, LegalZoom offer a free basic formation package that includes awesome perks like a digital welcome packet, a name check, and articles of formation.

Alternatively, for only $249 (plus state filing fees), you can purchase their Pro Package, which will grant you all the essentials you need to make your LLC formation journey as seamless as possible.

If you want a more affordable package, check out Alabama Registered Agent’s offer. Their LLC formation service fee is $100, and you can get a reputable registered agent for only $49.

FAQs

How Much Does It Cost to Set Up an LLC in Alabama?

The cost of forming an LLC in Alabama is $200.

What Is Needed to Form an LLC in Alabama?

In order to form an LLC in Alabama, you need to name your business, file a certificate of formation, get an EIN (if your business requires you to do so), and obtain all the necessary licenses and permits.

Do You Need a Business License for an LLC in Alabama?

Whether you need a business license to legally operate your Alabama LLC depends on the industry your business is in and its location. If your business includes selling certain goods and services, you’ll need to apply for a sales and use tax. Many licenses vary on the specific location of the business, so make sure you check with your local county to see if you need any additional licenses.

Can I Be My Own Registered Agent in Alabama?

Yes, the state of Alabama allows you to act as your own registered agent.

A Word of Farewell

We hope you enjoyed learning about all the steps you need to complete to officially form your LLC in Alabama.

There are some steps that are ubiquitous in every state, such as filing a certificate of formation and getting an Employee Identification Number. Other steps are optional, but they might be of immense help in allowing you to run your LLC smoothly, such as putting together an operating agreement.

Leave a Reply